When you invest, you buy assets that you think will grow in value or pay you income in the future. Investing involves making informed decisions about how to make your money work for you, and how to balance the risks and rewards.

Read more »ICI EDUCATION FOUNDATION'S

INVESTING ROAD TRIP

Investing is like a road trip. You choose your destination, vehicle, and path—but even if you plan carefully, you can’t predict everything that will happen on the journey.

Click on each sign to learn more.

What is investing?

How comfortable are you with risk?

Don't Put All Your Eggs in One Basket

Make Money on Your Money!

How do mutual funds simplify investing?

Get More Bang for Your Buck

Uncle Sam Can Help You Save

Rules of the Road

Setting savings goals

×Clearly identifying your savings goals—whether they’re short-term, long-term, or somewhere in the middle—helps to determine how you should invest your money.

Read more »How comfortable are you with risk?

×As an investor, you have to weigh the risks of an investment against its potential return—and against your personal comfort with risk.

Read more »Types of Investments

×When you buy a stock, you own a small part of a company (called a “share”).

When you buy a bond, you lend money to a company or government, which promises to pay you regular interest payments and to pay back your money at a future date.

Read more »Credit risk

×You buy a bond issued by the city where you live—but the city runs out of money and can’t pay its bondholders back. Credit risk—the possibility that a borrower may not repay its debt—is one of the risks of bond investing.

Read more »Don't Put All Your Eggs in One Basket

×Diversification—holding a variety of investments from many industries and geographic areas—helps to smooth out the ups and downs that they will experience over time.

Read more »Company-specific risk

×You own stock in a theme park company. After a hurricane, its most popular park must close for a year, and the company’s stock price falls. Company-specific risk is one of the risks of stock investing.

Read more »Make Money on Your Money!

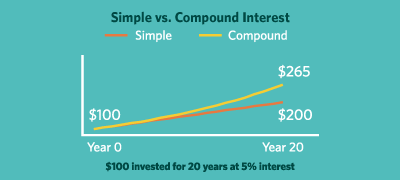

×When you earn money on an investment—called a return—and then invest that return, that money also earns returns. That’s a compound return.

Read more »

Read more »

Fees and expenses

×As with any service, investing isn’t free. The cost of investing has fallen sharply over the past 50 years, but it’s still important to ask about and understand the fees you’re paying.

How do mutual funds simplify investing?

×Buying different stocks and bonds can be costly and time-consuming. Most individual investors prefer to buy mutual funds instead. Funds are managed by professionals who buy a mix of stocks, bonds, and other assets. Because managers must invest according to clearly stated investment objectives, you can pick funds that match your goals.

Read more »Interest rate risk

×The Federal Reserve raises interest rates, which pushes down the value of stocks and bonds. Interest rate risk can affect the value of investments across a market.

Read more »Get More Bang for Your Buck

×When you invest automatically at regular intervals, you buy investments during both market ups and downs. When the market is down, your money buys more shares—that’s like buying on sale!

Read more »Inflation risk

×The price of most things you buy—like gasoline—tends to rise over time. Inflation risk is the possibility that your investment won’t grow enough to keep pace with rising costs.

Read more »Longevity risk

×You want your savings to go the distance. Reduce your longevity risk—the risk that you could outlive your nest egg—by saving early and taking care of your retirement “vehicle.”

Read more »Next post: Uncle Sam can help you save »

Uncle Sam Can Help You Save

×To encourage people to save, our federal and state governments give investors special tax treatment on money in savings plans for specific goals, like retirement and education.

Read more »Saving for a house

×If you buy a home, it will likely be the largest purchase you ever make. To get a mortgage—a loan to buy a house—you generally must pay 20% of the home’s cost up—front as a down payment.

Read more »Saving for education

×Every state (and the District of Columbia) offers a 529 plan, which is designed to help students save for education costs. A 529 plan must be used to pay for qualified education expenses to avoid taxes and penalties.

You can participate in any state’s 529 plan, but if you open a 529 plan account with your own state, you may be able to deduct your contribution from your state taxes.

Read more »Saving for retirement

×Most retirement plans let you put off paying taxes on the money you contribute and on your returns. Instead, you only pay tax when you take money out in retirement. Because your money grows tax-free, the power of compounding can really work for you. If you have a job, here are two great ways that you can save for retirement.

At work: Many employers offer a retirement plan—the 401(k) plan is the most common—and even help workers save more by adding money to their accounts. These plans let you choose from a variety of investments and save automatically from every paycheck.

On your own: If your employer doesn’t offer a plan, you can open an individual retirement account (IRA), which offer many of the same benefits as a 401(k). You can even start an IRA with money that you earn from a part-time or summer job.

Read more »Rules of the Road

×Clearly identifying your savings goals—whether they’re short-term, long-term, or somewhere in the middle—helps to determine how you should invest your money.

Read more »Start over: What is investing?